Getting a Zenith Bank token online isn’t that hard if you know the right process, and that is why I have decided to show you how to get a Zenith Bank Token number. Zenith Bank is one of the leading financial institutions in Nigeria, known for offering secure and innovative digital banking solutions.

One of the most important security features the bank provides is the Zenith Bank Token. This token plays a crucial role in protecting customers’ online transactions, ensuring that unauthorized individuals cannot access your account or perform fraudulent activities. Now, we are going to discuss:

- What is a Token, and why do you need it

- Why Do You Need a Zenith Bank Token

- Why Do You Need a Zenith Bank Token

- Types of Zenith Token

- Zenith Hardware Token

- Zenith eToken (Mobile App)

- How to get Zenith Bank Token Number

- The Requirement to get the Zenith Bank Token

- How to Use Zenith Bank Token Number

What is a Token and why do you need it?

Before we proceed, I would like to ask one question: What is the Zenith Bank Token Number, and why do you need one?

A Zenith Bank Token Number uniquely secures transactions by generating a 6-digit or 8-digit One-Time Password (OTP) every 30 to 60 seconds, either through a physical device (hardware token) or the Zenith Bank mobile app (soft token). The token is required whenever you want to:

- Transfer funds online (especially above certain limits).

- Make third-party payments.

- Pay bills and subscriptions.

- Carry out high-value transactions on Zenith Internet Banking.

- Authorize sensitive banking instructions.

Without this token, you may not be able to complete certain secure transactions on Zenith Bank’s digital platforms.

Why Do You Need a Zenith Bank Token?

Many customers wonder why a token is necessary when they already have a password or PIN. Here are the key reasons:

-

Enhanced Security: Passwords can be hacked, but a token generates unique codes every few seconds, making it extremely difficult for fraudsters to guess.

-

Transaction Authentication: Large or sensitive transactions require an additional verification step, which the token provides.

-

Fraud Prevention: Even if someone gains access to your login details, they cannot complete a transaction without the token number.

- Convenience: You can perform secure transactions anytime, anywhere, without visiting a bank branch

Types of Zenith Token

Zenith Bank Nigeria offers 2 types of tokens, known as hardware and Soft tokens. However, you might not be able to know how each type of token works.

Hardware Token: This device generates random one-time password (OTP) codes. Pressing a button displays a 6-digit code for authorizing transactions on your online banking platform.

- Pros: Works without an internet connection or a mobile network.

- Cons: You must carry the device with you.

Zenith eToken (Mobile App Token): This is a digital token generated via the Zenith Bank Mobile App. Once activated, you can generate OTP codes directly from your phone.

- Pros: Easy to use and always available on your mobile phone.

- Cons: Requires internet and a smartphone.

How to get Zenith Bank Token Number

I guess you are on this page because you want to know how to get the Zenith Bank Token number. There is a web address created to help generate a taken number. Follow these steps:

- Visit the Zenith Bank Selfcare Token page here

- Input your Zenith Bank Account number and click continue

- You will receive your token at the phone number linked to your account

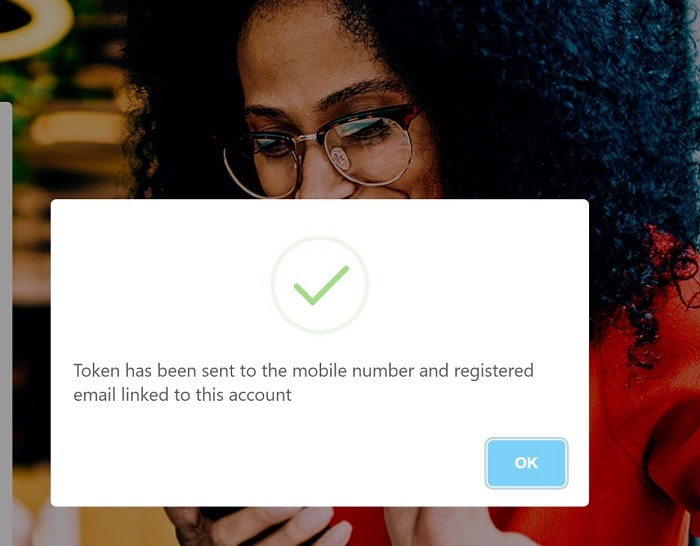

- The confirmation messages you will see will look like the image below.

Use the Zenith Bank eToken app)

One of the most convenient ways to get a Zenith eToken number is through the Zenith Token app, designed to allow Zenith customers to generate a Token on the go. Here is what to do:

- Download the Zenith Bank eToken mobile app. for Android users here, for Apple iPhone users here

- Activate with your ATM or visit the nearest Zenith Bank to enable the token

- Once you can activate the token, you will be ready to do a lot without vistibg your bank.

How to get the Zenith Bank token hardware?

The information I provided above is how to get a soft or eToken that only requires you to visit the Zenith Bank Token page or use their mobile app design for generate of token. However, we need to talk about the other type of token, which is the token hardware.

However, as I wrote earlier, the token hardware generates random one-time password (OTP) codes. When you press a button, the device displays a 6-digit code that authorizes transactions on your online banking platform. To get started, follow these steps:

Step 1: Visit a Zenith Bank Branch

Go to any Zenith Bank branch near you and request a Token Application Form. Fill in your details, including your account number, phone number, and email address.

Step 2: Choose Token Type

Indicate whether you want a hardware token or a soft token. If you prefer a hardware token, you will pay a small fee. If you want the mobile app token, you will be guided on how to activate it.

Step 3: Submit Form and Provide ID

Submit the completed form along with a valid ID card for verification.

Step 4: Collect Your Token

For hardware tokens, the bank either gives you the device immediately or tells you to return in a few days to collect it. For soft tokens, the bank sends activation instructions to you via SMS or email.

Step 5: Activate Your Token

For Hardware Token: Log in to Zenith Internet Banking, go to “Token Synchronization,” enter the token serial number and the generated OTP to activate.

For Soft Token: Download and install the Zenith Bank Mobile App. Navigate to the “Token” section and follow the activation process using the activation code sent to your email or SMS. Once activated, you can begin generating your Zenith Bank token numbers for transactions.

Zenith Bank Token Requirements

Not every Zenith customer is allowed to generate and use tokens; it all depends on the account types, and you must activate the services. Before applying for a token, you need the following:

- An active Zenith Bank account.

- A valid means of identification (NIN, voter’s card, driver’s license, or international passport).

- Your registered phone number and email address are linked to your Zenith Bank account.

- Filled Token Request Form (available at Zenith Bank branches or online).

- A processing fee (usually around ₦2,500 for hardware tokens; soft tokens are often free).

All these requirements apply only to the hardware token, while you can download and activate the software token from anywhere without visiting the bank or submitting any identification documents.

Troubleshooting

Zenith Bank Token Issues Sometimes, customers may experience issues with their token. Common problems include:

- Token Not Generating Code: Replace battery (for hardware token) or reinstall app (for soft token).

- Invalid OTP: Synchronize your token on the internet banking portal.

- Lost Token Device: Visit the bank immediately to block and request a replacement.

- Forgotten Token PIN (Soft Token): Reset through the app or by contacting Zenith Bank support.

For urgent issues, you can contact Zenith Bank Customer Care via: Phone: 01 278 7000 Email: zenithdirect@zenithbank.com Live Chat: Available on the official Zenith Bank website

FAQs About Zenith Bank Token Number

1. How much does a Zenith Bank token cost? Hardware tokens cost about ₦2,500, while soft tokens via the mobile app are free.

2. Can I get a Zenith token online? You must visit a branch for hardware tokens, but you can activate a soft token online through the mobile app.

3. What is the difference between OTP via SMS and Token? The bank sends SMS OTPs to your phone, but hackers can intercept them. A token generates secure codes instantly, making it safer.

4. How long does it take to get a token? Hardware tokens may be issued instantly or within 48 hours. Soft tokens can be activated the same day.

5. Can I use one token for multiple Zenith accounts? No. Each token is linked to a specific account for security reasons.

Conclusion

Zenith Bank token number is an essential step for securing your online banking. Moreover, whether you choose a hardware token or a soft token through the mobile app, this token ultimately guarantees that only you can authorize sensitive transactions on your account.

To ensure maximum security and convenience, I recommend activating the soft token via the Zenith Bank Mobile App. It is free and always accessible on your smartphone.